Amazon just revealed a $114 ad-supported Kindle e-reader--a savings of $25 on the regular price of the device. It comes with a ton of questions.

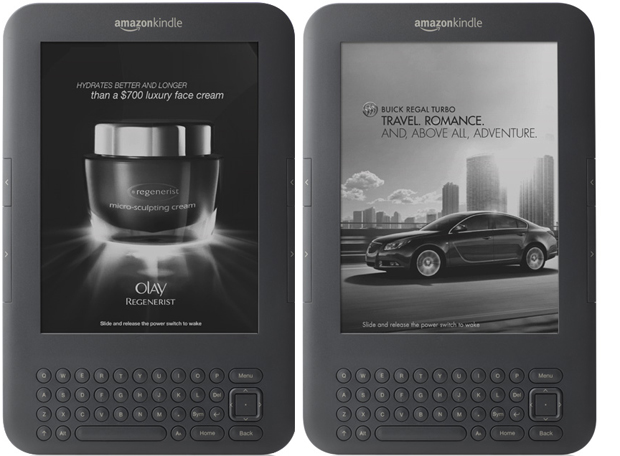

"Millions of people are reading on Kindle," Amazon noted. And in just "five months the latest-generation Kindle became the bestselling product in the 16-year history of Amazon.com." But Amazon isn't content with mere "millions" of users, and wants more--one of the easiest ways to do this without radically overhauling your product, your PR engine or your infrastructure, is to lower the price to make it affordable to more people. Hence the $25 price drop offered by the "Kindle with Special Offers," which drops ads onto the "same #1 bestselling Kindle" on the bottom of the home screen and "sponsored screensavers," those beautiful digitally rendered e-ink portraits previously and often reserved for dead authors.

The first question you could ask is, why's Amazon doing this despite its "record-breaking" success? It's probably more than coincidental that the iPad 2 that launched a few weeks ago is selling like hotcakes, and numerous analysts and industry insiders are predicting it will sell by the tens of millions this year alone. While it will dominate the market, it'll also bring a number of Android units in its wake--meaning the public will get more used to seeing tablets on the shelves literally every week this year. They'll be color-display units, sporting apps and games and ebooks, and Amazon's Kindle will start to look very much like the weaker sibling despite its lower price and allegedly eye-friendly e-ink display. So Amazon's trying to buffer its sales. Skeptics could suggest Amazon hasn't got a better product coming any time soon.

Then there's the question of how much money Amazon's trying to make. By dropping the price by $25 (which is a slightly notional amount, not too high, not too low) Amazon's saying it's going to lose $25 of its unit profit on the device, and then recoup at least that figure--per user--from ad revenues generated over the device's lifespan. That doesn't sound like those ads are earning a lot of money per impression. Imagine a situation where a Kindle owner sees a homescreen ad once a day for a whole year--that puts each ad income at just under 7 cents to recoup the entire $25 inside a year.

As has been suggested elsewhere, the $114 figure by itself is an odd choice. For just $15 more price drop, the Kindle would've slid below $100 to the magic cheap-sounding, almost impulse-buying $99. Even if you consider this a "race to the bottom" that figure would've made the Kindle appeal to many, possibly very many, more customers. And even if this sales figure ate into Amazon profits, the sheer volume of sales the company may have achieved could've more than compensated for this. Remember that buyers of the $114 Kindle can later choose to get rid of ads by paying back the $25--and it would seem Amazon just doesn't trust the ad model entirely.

We know Amazon patented adverts in e-books themselves (not just the interface of the Kindle) back in 2009. So dare we suspect that the $114 Kindle is just the first step in a greater plan for Amazon? A kind of public-testing move to see if people are prepared to accept ads peppered throughout their ebook experience. Because that's a pretty controversial change to the book-reading experience, even though consumers are used to seeing ads everywhere online--jewelry ads dotted through, say, Lord of the Rings is a whole different thing. By measuring who "tolerates" the ads, and who pays the $25 back to get rid of them, Amazon could get a lot of interesting data.

To read more news like this follow Kit Eaton himself and Fast Company on Twitter.

Read More: The Amazon Kindle's New, Old Threat: Barnes & Noble's Nook Is Coming on Strong